SPJ Adjusting Services Recovers Full Estimate for North Carolina Fire Damage Claim

April 17, 2025

1 min read

At SPJ Adjusting Services, we’re committed to ensuring policyholders receive the full settlement they’re entitled to after suffering a property loss. A recent fire damage claim in North Carolina showcases our dedication, expertise, and ability to deliver results.

The insured faced significant fire damage to their property, but the carrier’s initial offer fell short of covering the full scope of repairs and restoration. Recognizing the need for professional advocacy, the insured turned to SPJ Adjusting Services for assistance.

Our team immediately conducted a comprehensive fire damage inspection, including structural assessments, smoke and soot analysis, and a detailed evaluation of the property’s contents. Leveraging our expertise in fire damage claims and advanced tools like Xactimate L3, we meticulously documented every aspect of the loss. This included detailed measurements, photographs, and estimates that adhered to local codes, IICRC guidelines, and manufacturer recommendations.

Through diligent communication and strategic negotiations with the carrier, we successfully recovered 100% of the estimated costs for the insured. This outcome ensured the policyholder had the necessary resources to fully restore their property without financial strain.

This case highlights the importance of having an experienced advocate like SPJ Adjusting Services to navigate the complexities of fire damage claims. With over 12 years of experience, certifications such as IICRC FSRT and WTR, and a proven track record of success, we are dedicated to protecting the interests of policyholders nationwide.

If you’re facing challenges with a fire damage claim, contact SPJ Adjusting Services today. Let us help you secure the settlement you deserve and restore your property with confidence.

SPJ Adjusting Services Secures $136,000 Increase in Business Claim Settlement

April 16, 2025

1 min read

At SPJ Adjusting Services, we pride ourselves on delivering exceptional results for our clients by ensuring they receive the full insurance benefits they are entitled to. A recent business claim highlights the critical role we play in advocating for policyholders.

At SPJ Adjusting Services, we pride ourselves on delivering exceptional results for our clients by ensuring they receive the full insurance benefits they are entitled to. A recent business claim highlights the critical roThe insured initially received a settlement offer from their carrier that was far below what was required to restore their property and operations. Frustrated and unsure of how to proceed, they reached out to SPJ Adjusting Services for assistance.le we play in advocating for policyholders.

Our team immediately conducted a comprehensive evaluation of the property, leveraging our expertise in commercial claims. Using advanced tools we meticulously documented the damage, provided detailed estimates, and ensured that all local codes, guidelines, and manufacturer recommendations were accounted for. This thorough approach uncovered significant damages and repair needs that the initial assessment had overlooked.

Through strategic negotiations and clear communication with the insurance carrier, SPJ Adjusting Services successfully secured a $136,000 increase in the settlement. This outcome not only allowed the insured to address all necessary repairs but also helped them restore their operations without financial strain.

This case underscores the importance of having an experienced advocate like SPJ Adjusting Services to navigate the complexities of insurance claims. Whether it’s fire, wind, hail, or water damage, our team is dedicated to protecting your interests and achieving the best possible outcome for your claim.

If you’re facing challenges with your insurance claim, contact SPJ Adjusting Services today. Let us ensure you receive the settlement you deserve.

SPJ Adjusting Services Secures Significant Increase in Fire Damage Claim Settlement

April 15, 2025

1 min read

At SPJ Adjusting Services, we specialize in honestly Appraising losses for policyholders to ensure they receive the full and fair settlement they deserve. A recent fire damage claim exemplifies the value of having a skilled and experienced adjuster on your side.

Initially, the insurance carrier offered a settlement that fell far short of covering the true extent of the damage. This left the insured feeling overwhelmed and uncertain about how to proceed. Recognizing the need for a more accurate evaluation, the insured enlisted SPJ Adjusting Services to perform an appraisal on the file.

Our comprehensive approach began with a detailed inspection, including structural assessment, smoke and soot analysis, and contents evaluation. Leveraging our expertise in fire damage claims and our proficiency with advanced tools like Xactimate L3, we meticulously documented the full scope of the loss. This included providing precise measurements, photographs, and compliance with local codes, IICRC guidelines, and manufacturer recommendations.

Through diligent communication with the carrier, backed by thorough documentation and data-driven estimates, we successfully negotiated a substantial increase in the settlement. The result? A $330,100 increase from the initial offer, ensuring the insured could fully restore their property without financial strain.

This case underscores the importance of having a knowledgeable advocate like SPJ Adjusting Services to navigate the complexities of insurance claims. Whether it’s fire, wind, hail, or water damage, our team is committed to delivering results that protect your interests and your property.

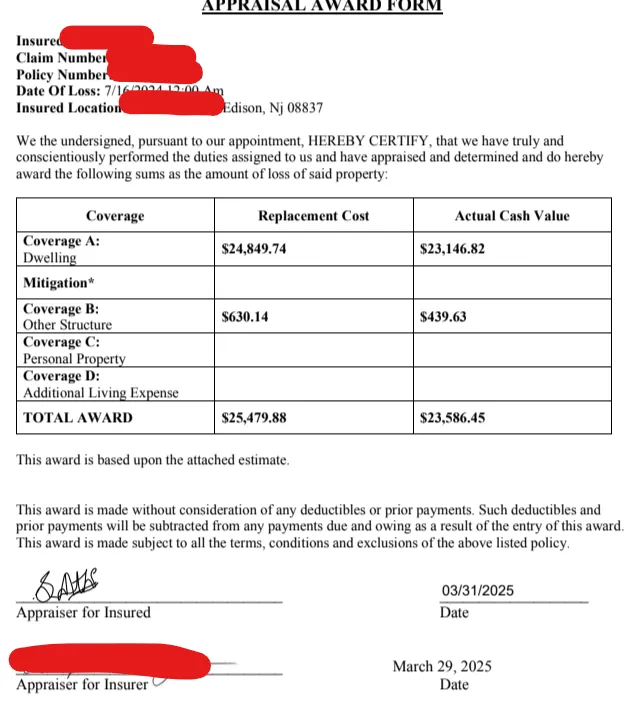

Roof Repair turned Replace after Appraisal in Edison NJ

April 16, 2025

1 min read

The wind damage to the roof initially appeared minimal, prompting the carrier adjuster to create a straightforward estimate focused on repairing a few shingles affected by the storm. This approach aimed to settle the claim quickly, minimizing further involvement from the insurance company. Unfortunately, the insured, lacking a deep understanding of insurance claims and the implications of the adjuster’s estimate, accepted the claim’s closure without fully grasping the potential long-term consequences for their property. This left them feeling uncertain and confused about how to proceed with their roof’s condition.

The claim was later referred to me by a prior customer who had faced a similar situation and benefited from my expertise. Upon engaging with the insured, it became evident that they felt overwhelmed and unsure of their rights regarding the claim. During a detailed consultation, I clarified their situation and emphasized the importance of the appraisal clause in their insurance policy. This clause allows for a more thorough assessment of damages, particularly in disputes over the extent of damage or repair requirements. Empowered by this knowledge, the insured chose to reopen the claim and invoke the appraisal clause, seeking a comprehensive evaluation of their roof’s condition.

The case presented a unique challenge, particularly in communicating with the opposing adjuster (OA). While the visible wind damage was minor, the roof’s overall condition was far from adequate due to its age—exceeding 20 years—and signs of wear and deterioration. These factors rendered it unsuitable for simple repairs. To substantiate this, I conducted several repairability tests in collaboration with the opposing appraiser. These tests assessed the roof’s structural integrity and the feasibility of repairing the damaged areas. The findings demonstrated that a full roof replacement was necessary, as patchwork repairs were not viable.

Through persistent efforts, involving detailed documentation, numerous phone calls, and emails, I successfully convinced the OA of the need for a complete roof replacement. This resulted in a unanimous award in favor of the insured, eliminating the need for an umpire and expediting the resolution process. The outcome underscored the critical importance of a comprehensive evaluation of property conditions, particularly when age and prior damage intersect. This case not only highlighted the complexities of insurance claims but also reinforced the value of having knowledgeable advocates to ensure insured parties receive the coverage they are entitled to based on the true condition of their property.

Appraisal Results in almost 70k increase in Hurricane Beryl Claim in Woodlands, TX

April 14, 2025

1 min read

Award RCV : $141,111.19

Award ACV : $109,438.10

Carrier Estimate: $73,320.74.

High winds from Hurricane Beryl, caused a 40 yr old tree to fall on the house damaging the roof, exterior brick and knocked out the electrical panel. The electricity to the entire house was shut down, water gushed inside the house and the Left elevation brick exterior wall was leaning. The garage was crushed under the tree.

Carrier “Experts” adjusted the claim as usual and said it will buff right off (Pun intended). Insured, who is more than 70 yrs old with a disabled spouse hired an engineer to look at the damage caused. He got contractor Bids totaling about 150k in proposed repair costs on top of the tree removal, clean up and emergency services.

Months later, numerous emails were exchanged between the insured and carrier and the carrier offered $73,320.74.

Insured, confident that he will not be able to repair the damages in that budget, opted for Appraisal and hired Sarath Jerome to perform an independent insurance appraisal on this loss. An appraisal demand letter was sent to the carrier. The carrier interviewed the proposed appraiser to confirm his certifications and experience. Finally, the carrier agreed to the appraisal.

An Independent and Un-biased appraisal was conducted, and the scope of loss was determined to be almost 70k higher than the initial carrier offer. Jerome was able to convince the carrier about each code upgrades needed, permits and even justified the cost of engineering assessment.

Chicago, IL home get Roof Replacement Approved after Insurance Appraisal

April 14, 2025

1 min read

RCV : $18,892.20 (Roof Replacement)

ACV : $12,996.40 (Roof Replacement)

Carrier Estimate: $ 4,168.34 (Roof Repair)

I have lost the count of times I have blogged about Repair Vs Replacement argument on roof claims.

Roofs become unrepairable after about 5-7yrs of installation due to the following reasons:

Repairability : Shingles usually becomes brittle after being exposed to the heat and cold and changing seasons. When you try to perform a repair on the damaged shingle, it will break the next one, then the next one and the next one. This happens until the entire roof will have to be replaced.

Matching : Shingles are like clothing, the manufactures switch out colors, textures, thickness and even materials over the year. Several reasons contribute to this – Advanced Materials, available of raw materials and simply older patterns go out of trend

Algae Growth and Fading : Even if you were to find the exact same shingles, the possibility of anything that has been sitting in the weather for more than 5 yrs to match a brand new item is next to impossible. The shingles on your roof will be faded with algae growth, blistering etc. You will never be able to reach a uniform appearance mixing new and old shingles.

This appraisal was a classic case of the Repair vs Replacement argument. The carrier did a sample matching using a third-party vendor called ITEL ( ITEL take a sample of the shingles and provide a report of matching or comparable products. However my opinion is that the ITEL is biased, because almost all other business comes from the carriers). This case showed a matching on ITEL.

Once I took a look at the file, it was clear that the shingles will not be matching. I went down to the roofing supply store, purchased the product that was the closest match. Upon lying it down on the roof itself, the difference was very visible. This was documented and reported to the carrier, who now had no other option, but to replace the whole roof.

This we added one more win to the Repair Vs Replace argument adding to the more than 200 similar wins in my last 4 yrs.

Naperville, IL home sees claim payout increase from 80k to nearly 240K after Appraisal

April 14, 2025

1 min read

Award RCV : $231,967.91

Award ACV : $196,545.81

Carrier Estimate: $79,534.45

Mr. Kumar had a beautiful 6000+sqft home with expensive ¾” wood shake shingles. Hail caused damage to the wood shake roof, custom copper roofing elements and other soft metals including copper valleys.

As usual, the carrier send in an adjuster and he get the news that the shingles can be repaired individually. The carrier counted about 125 shinlges damaged by hail and wrote an estimate, to replace them individually. Carrier also notted that the copper and other metals on the roof had hail damage, but was cosmetic in nature and does not need fixing.

Jerome was hired to perform an appraisal on this loss. The insured had a phone conversation with Mr. Jerome to qualify his as the Appraiser. He was immediately impressed with his knowledge, credentials and expertise.

The appraisal was invoked, but the two appraisers were not able to reach a resolution. This is one of the rare instances where Mr. Jerome had to bring in an Umpire to make a ruling on the difference.

The umpire performed an independent and unbiased inspection and provided a rulling about $150k higher than the initial carrier estimate.

The appraisal process took about 5 months to complete, a bit more than normal. But it provided the insured a great outcome at $231,967.91.

Contractor’s Guide to Securing Approval for Roof Damage Insurance Claims Damage

April 14, 2025

1 min read

Getting your roof damage insurance claim approved doesn’t have to be a daunting process. As an experienced insurance adjuster with over 12 years in the field and Haag Certification for both Residential and Commercial Roofs, I’m sharing essential tips to help you navigate this journey successfully.

1. Document Everything Immediately

Take extensive photographs of all damage, both interior and exterior

Capture wide-angle shots and close-ups of specific damage areas

Document the date and time when you first noticed the damage

Keep records of any temporary repairs made to prevent further damage

2. Understand the Policy Coverage

Review your insurance policy before filing a claim

Know your deductible amount

Understand what types of roof damage are covered (wind, hail, falling objects)

Be aware of any exclusions in your policy

3. Act Quickly and Safely

Report the damage to the insurance company as soon as possible

Take immediate measures to prevent further damage (if safe to do so)

Keep all receipts for temporary repairs or emergency services

Don’t delay – many policies have time limits for filing claims

4. Hire a Professional Roof Inspector

Work with a certified roof inspector who can provide detailed documentation

Ensure they have experience with insurance claims

Get a comprehensive inspection report with photos and detailed findings

Have them document the cause of damage and recommended repairs

5. Maintain Detailed Records

Keep a log of all communications with your insurance company

Save emails and take notes during phone conversations

Document the names and contact information of everyone you speak with

Retain copies of all estimates, invoices, and reports

6. Give the Insurance Adjuster what he wants

This where I show my expertise. I speak the adjuster’s language

I create a detailed Xactimate/Symbility report, like the top Adjuster in his firm would do

My detailed photo report makes it impossible to say no!

No need to argue, just document the hell out of it.

7. Consider Professional Help

Consider hiring a public adjuster for complex claims

Consider working with other experts like Engineers

Consult with a roofing contractor who understands insurance claims

8. Be Present During Inspections

Attend the insurance adjuster’s inspection when possible

Point out all areas of concern

Ask questions about their findings

Request a copy of their inspection report

9. Review the Settlement Offer Carefully

Don’t rush to accept the first offer

Ensure all damage is included in the scope of repairs

Verify that local building codes are considered

Check if depreciation is recoverable

10. Appeal If Necessary

Know your rights to appeal a denial or low settlement

Provide additional documentation if requested

Consider the appraisal process for dispute resolution

Don’t be afraid to escalate issues to supervisors

Expert Tips: Consider Appraisals

Initiating the Appraisal process if necessary

Pick a competent Appraiser who has the knowledge and expertise need for the type of claim.

Reach an Award which is binding in most states

What is special about an appraisal? It forces the carrier to pick an independent and non-biased expert in the field. This appraiser is not bound by the carrier’s rules which are very restrictive in most cases.

Red Flags to Watch For:

Insurance adjusters who rush through inspections

Pressure to accept immediate settlements

Contractors who offer to pay your deductible (this is illegal in many states)

Unexplained claim denials without proper documentation

Remember, successful insurance claims often come down to documentation and persistence. The more organized and thorough you are in presenting your claim, the better your chances of approval. If you’re feeling overwhelmed, don’t hesitate to seek professional assistance from qualified insurance adjusters or public adjusters who can advocate on your behalf.

By following these guidelines and maintaining clear communication with your insurance company, you’ll be better positioned to get your roof damage claim approved and receive fair compensation for your damages.

Now, If that does not answer you question – Book a consultation with me.

5X Increase in Award for Roof Claim in Indianapolis, IN

April 13, 2025

1 min read

5X Increase of $25,581.40 achieved within 118 days of Appraisal Assignment.

Carrier Estimate : $4,312.46

Appraisal Award : $29,893.86

Settlement Award : $25,581.40

Days to Award : 118

The wind damage on the roof was minimal, which initially led the carrier adjuster to create a straightforward estimate focused solely on repairing the few shingles that had been damaged by the storm. This estimate was intended to close out the claim quickly and efficiently, minimizing further involvement from the insurance company. However, the situation was not as simple as it appeared at first glance. The insured, having limited knowledge of the intricacies of insurance claims and the implications of the adjuster’s estimate, accepted the closure of the claim without fully understanding the potential ramifications for their property. This lack of awareness left them feeling uncertain and confused about the next steps they should take regarding their roof’s condition.

At this time, the claim came to me as a referral from my prior customer, who had experienced a similar situation and had benefited from my expertise. When I engaged with the insured, it became clear that they were feeling overwhelmed by the process and unsure of their rights regarding the claim. After a thorough consultation, I explained the nuances of their situation, emphasizing the importance of understanding the appraisal clause in their insurance policy. This clause allows for a more detailed assessment of the damages, particularly when there is a disagreement about the extent of the damage or the necessary repairs. Encouraged by this information and feeling empowered to take action, the insured made the decision to reopen the claim and invoke the appraisal clause, seeking a more comprehensive evaluation of their roof’s condition.

This case presented a significant challenge, particularly in my efforts to explain the situation to the opposing adjuster (OA). It was crucial to convince him that while the visible wind damage was indeed minimal, the overall condition of the roof was far from satisfactory. The roof, having surpassed 20 years of age, exhibited signs of wear and deterioration that rendered it unsuitable for repair. I took the initiative to perform several repairability tests in collaboration with the opposing appraiser, which involved a detailed examination of the roof’s structural integrity and the feasibility of patching the damaged areas. These tests were instrumental in demonstrating that, despite the minor damage, the roof’s age and overall condition necessitated a full replacement rather than a piecemeal repair approach.

After extensive communication involving numerous phone calls, emails, and the compilation of thorough documentation, I was finally able to persuade the OA of the necessity of a complete roof replacement. This breakthrough was significant, as it led to a unanimous award in favor of the insured without the need for an umpire, thus streamlining the process. The outcome was a classic victory in the ongoing debate of repair versus replacement, underscoring the importance of a comprehensive evaluation of property conditions, especially in cases where age and prior damage intersect. This experience not only highlighted the complexities of insurance claims but also reinforced the value of having knowledgeable advocates in the process, ensuring that insured parties receive the coverage they are entitled to based on the true condition of their property.

We work with all insurance companies: We negotiate directly with you insurance so you don’t have to

+ many more...

712% Average Payout Increase:

Get the Full Payment you Deserve

Our public adjusters excel at settling denied claims and increasing settlement amounts for both residential & commercial claims.

Residential Claims

We specialize in helping homeowners with insurance claims, especially when claims are denied or the offered amount isn't enough to cover repairs. Our team works hard to negotiate fair settlements, ensuring homeowners get the money they need to fix their homes.

Commercial Claims

We specialize in commercial insurance claims, when business owners face denials or insufficient offers that can disrupt operations and income. With a team of engineers, adjusters, and estimators, we ensure fair settlements, minimizing business disruptions and financial impacts.

97% Success Rate:

Settle your claim for maximum compensation

On average, our clients receive a 712% larger payout on their insurance claims

With a 97% success rate, our public adjusters excel at settling denied claims and increasing settlement amounts.

Our expertise in thoroughly understanding your policy and providing accurate estimate documentation ensures you receive the compensation you deserve.

This turns frustrating claim rejections into fair and satisfactory outcomes.

Proven Success in Insurance Claims: Real Case Studies, Real Results

Fire Damage

with Travelers

Other Attorney

$214,872

Claim Warriors

$418,317

“Claim Warrior was a lifesaver stepping into navigate the fire damage claim when the insurance representative was unresponsive and evasive.”

Danny A.

Roof Damage

with Progressive

Other Adjuster

$4,295

Claim Warriors

$51,618

“Claim Warrior proved storm damage caused roof issues. countering the insurance claims of contractor error, and getting me a fair settlement to repair my roof.”

John W.

Water Damage

with Allstate

Original Settlement

DENIED

Claim Warriors

$114,473

“Insurance company initially offered too little and didn’t want to pay. Claim Warrior helped me get fair compensation for water damage from a pipe burst.”

Kelly P.

FAQ

When should I hire a public adjuster?

Lorem ipsum dolor sit amet, consectetur adipisicing elit. Autem dolore, alias, numquam enim ab voluptate id quam harum ducimus cupiditate similique quisquam et deserunt, recusandae.

How does Claim Warrior get paid?

We work on a contingency fee basis, which means we receive a percentage of the final insurance settlement. This fee is agreed upon before they begin work on your claim.

Why should I choose a public adjuster over handling the claim myself?

Public adjusters bring specialized expertise in insurance policies, claims procedures, and negotiation tactics. They can often secure higher settlements than policyholders can negotiate on their own, and they handle all the complexities of the claims process, saving you time and reducing stress.

What if I've already received a settlement offer from my insurance company?

Even if you’ve received a settlement offer, a public adjuster can review it to ensure it adequately covers all damages and losses. They can negotiate with the insurance company for a higher settlement if necessary.